What are the recent developments in Indian stock market?

What

are the recent developments in Indian stock market?

The Indian regulatory and supervisory framework of

securities market in India

1. Extensive Capital Market Reforms were

undertaken during the 1990s encompassing legislative regulatory and

institutional reforms. Statutory market regulator, which was created in 1992,

was suitably empowered to regulate the collective investment schemes and

plantation schemes through an amendment in 1999. Further, the organization

strengthening of SEBI and suitable empowerment through compliance and

enforcement powers including search and seizure powers were given through an amendment

in SEBI Act in 2002. Although dematerialisation started in 1997 after the legal

foundations for electronic book keeping were provided and depositories created

the regulator mandated gradually that trading in most of the stocks take place

only in dematerialised form.

2. Till 2001 India

3. After the legal framework for

derivatives trading was provided by the amendment of SCRA in 1999 derivatives

trading started in a gradual manner with stock index futures in June 2000.

Later on options and single stock futures were introduced in 2000-2001 and now India s derivatives market turnover is more than

the cash market and India

4. India

5. India

6. In June 2003 the interest rate futures

contracts on the screen based trading platform were introduced.

7. India

8. RBI has introduced the Real Time Gross

Settlement system (RTGS) in 2004 on experimental basis. RTGS will allow real

delivery v/s. payment which is the international norm recognized by BIS and

IOSCO.

9. To improve the governance mechanism of

stock exchanges by mandating demutualisation and corporatisation of stock

exchanges and to protect the interest of investors in securities market the

Securities Laws (Amendment) Ordinance was promulgated on 12th October 2004. The Ordinance has since

been replaced by a Bill.

10.

New Measures of Risk Management System in

Indian Capital Market

Every shareholder or investor wants to protect his investment and promote it as his source of earning. So, my always concentration is on new measures the Risk management system of SEBI which is the controller of Indian Capital Market. SEBI did several steps in this regards.

{ A } Measures for Reducing Price Volatility

Price volatility is the relative rate at which the price of a security moves up and down.

But this technique of profit maximization which is used by bad guys for wrong purposes. They buys shares at very cheap rates and sell when overpriced. Because, they get idea of trend of next price of shares with invalid source instead of using mathematical formula

Using a simplification of the formulas above it is possible to estimate annualized volatility based solely on approximate observations. Suppose you notice that a market price index, which has a current value near 10,000, has moved about 100 points a day, on average, for many days. This would constitute a 1% daily movement, up or down

Every shareholder or investor wants to protect his investment and promote it as his source of earning. So, my always concentration is on new measures the Risk management system of SEBI which is the controller of Indian Capital Market. SEBI did several steps in this regards.

{ A } Measures for Reducing Price Volatility

Price volatility is the relative rate at which the price of a security moves up and down.

But this technique of profit maximization which is used by bad guys for wrong purposes. They buys shares at very cheap rates and sell when overpriced. Because, they get idea of trend of next price of shares with invalid source instead of using mathematical formula

Using a simplification of the formulas above it is possible to estimate annualized volatility based solely on approximate observations. Suppose you notice that a market price index, which has a current value near 10,000, has moved about 100 points a day, on average, for many days. This would constitute a 1% daily movement, up or down

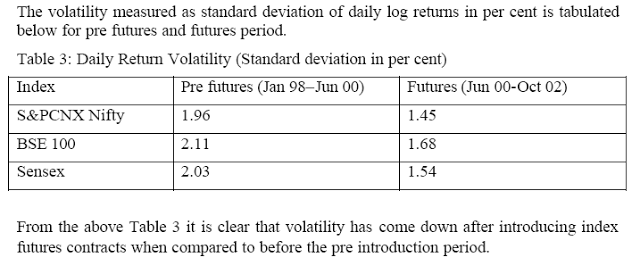

Volatility is often viewed as a negative term in the market that represents uncertainty and risk. Higher volatility brings worry to the investors as they watch the value of their portfolios move wildly and decrease in value. To reduce price volatility and stability in the prices of stock market, A major reform undertaken by SEBI was the introduction of derivatives products: Index futures, Index options, stock options and stock futures.

{B} Place Circuit Breakers

This is another recent development in Indian Capital Market. We all know an excessive speculation is always risky for every investor. For reducing it, SEBI has introduced place circuit breakers.

A circuit breaker is the system which stops to trade in stock market when prices move after a specific level. For example, if a stock is at Rs. 100 and circuit breaker is fixed at 5%, then stock trading will stop if it hit of Rs. 95 or Rs. 105. There are mainly two types of circuit breakers. One is index wise circuit breakers and other is stock wise circuit breakers. The index-based market-wide circuit breaker system applies at 3 stages of the index movement, either way viz. at 10%, 15% and 20%. These circuit breakers when triggered bring about a coordinated trading halt in all equity and equity derivative markets nationwide. The market-wide circuit breakers are triggered by movement of either the BSE Sensex or the NSE S&P CNX Nifty, whichever is breached earlier. In case of a 10% movement of either of these indices, there would be a one-hour market halt if the movement takes place before 1:00 p.m. In case the movement takes place at or after 1:00 p.m. but before 2:30 p.m. there would be trading halt for ½ hour. In case movement takes place at or after 2:30 p.m. there will be no trading halt at the 10% level and market shall continue trading. In case if the market hits 10% before 1 p.m. then as explained there would be a one hour halt in trading and after resumption of trade in case if the market hits 15% in either index, then there shall be a two-hour halt. If the 15% trigger is reached on or after 1:00p.m. but before 2:00 p.m., there shall be a one-hour halt. If the 15% trigger is reached on or after 2:00 p.m. the trading shall halt for the remaining part of the day

{C} Intraday Trading Limit

Intraday Trading, also known as Day Trading, is the system where you take a position on a stock and release that position before the end of that day's trading session. Thereby making a profit for yourself in that buy-sell or sell-buy exercise. All in one day.

{D} Mark to Market Margin

MTM margin is imposed to cover loss that a member may incur, in case the transaction is closed out at a closing price different from a price at which the transaction has been entered.

This is another recent development in Indian Capital Market. We all know an excessive speculation is always risky for every investor. For reducing it, SEBI has introduced place circuit breakers.

A circuit breaker is the system which stops to trade in stock market when prices move after a specific level. For example, if a stock is at Rs. 100 and circuit breaker is fixed at 5%, then stock trading will stop if it hit of Rs. 95 or Rs. 105. There are mainly two types of circuit breakers. One is index wise circuit breakers and other is stock wise circuit breakers. The index-based market-wide circuit breaker system applies at 3 stages of the index movement, either way viz. at 10%, 15% and 20%. These circuit breakers when triggered bring about a coordinated trading halt in all equity and equity derivative markets nationwide. The market-wide circuit breakers are triggered by movement of either the BSE Sensex or the NSE S&P CNX Nifty, whichever is breached earlier. In case of a 10% movement of either of these indices, there would be a one-hour market halt if the movement takes place before 1:00 p.m. In case the movement takes place at or after 1:00 p.m. but before 2:30 p.m. there would be trading halt for ½ hour. In case movement takes place at or after 2:30 p.m. there will be no trading halt at the 10% level and market shall continue trading. In case if the market hits 10% before 1 p.m. then as explained there would be a one hour halt in trading and after resumption of trade in case if the market hits 15% in either index, then there shall be a two-hour halt. If the 15% trigger is reached on or after 1:00p.m. but before 2:00 p.m., there shall be a one-hour halt. If the 15% trigger is reached on or after 2:00 p.m. the trading shall halt for the remaining part of the day

{C} Intraday Trading Limit

Intraday Trading, also known as Day Trading, is the system where you take a position on a stock and release that position before the end of that day's trading session. Thereby making a profit for yourself in that buy-sell or sell-buy exercise. All in one day.

{D} Mark to Market Margin

MTM margin is imposed to cover loss that a member may incur, in case the transaction is closed out at a closing price different from a price at which the transaction has been entered.

It is just collection in cash for all futures contracts and adjusted against the available Liquid Networth for option positions. In the case of futures Contracts MTM may be considered as Mark to Market Settlement.

2. Investigations

If any company law or SEBI Act's rules regarding indian capital market are voilated, its investigation is done by SEBI. This is the list of cases resulted in compounding in the prosecution filed by SEBI (As on 30th June 2010).

3. Investor Awareness Campaign

For making Indian capital market more secure for indian and foreign investors, SEBI has started investors awareness campaign. For this, SEBI has made his official site's sub domain athttp://investor.sebi.gov.in/

Under this campaign, Workshops/ Seminars Conducted by Investor Associations recognised by SEBI. There are following things are included :

Caution to Investors

Do not enter into securities

transactions with unregistered intermediaries.

· Do

not get carried away by advertisements promising unrealistic gains and windfall

profits.

· Do

not invest based on market rumours or unconfirmed or unauthentic news.

· Be

aware that advice through television or print media does not mean that it is

the opinion of the channel or publisher.

4. Ban on Inside

Trading

Insider trading is the trading of a corporation's stock

or other securities (e.g. bonds or stock options) by individuals with potential

access to non-public information about the company. In most countries, trading

by corporate insiders such as officers, key employees, directors. To ban

on inside trading, SEBI has made ( Prohibition of Insider Trading)

Regulations, 1992. Its updated

amendment in 2010says in clear words

No insider shall—when in possession of any unpublished price sensitive information; [(ii) communicate [or] counsel or procure directly or indirectly any unpublished price sensitive that nothing contained above shall be applicable to any communication required in

[or profession or employment] or under any law.][***] company

while in possession of any unpublished price sensitive information.] No company

shall deal in the securities of another company or associate of that other either on his own behalf or on behalf of any

other person, deal in securities of a company listed on any stock exchange or information

to any person who while in possession of such unpublished price sensitive information

shall not deal in securities Provided the ordinary course of business

5. Trading Cycle Under T + 2

T' represents the trade day.

'T + 2' implies the settlement on the 2th trading day.

SEBI has reduced the settlement cycle upto T +2 and in future, it may be T + 1

settlement cycle. But SEBI acceptedshorter settlement cycles will mean more pressure on trade

processing systems so that funds/securities are ready for pay-in/pay-out on the

next day.

Comments

Post a Comment