Discuss the various steps involved in portfolio investment process?

Discuss the

various steps involved in portfolio investment process?

Portfolio is a combination of

securities such as stocks, bonds and money market instruments. The process of

blending together the broad asset classes so as to obtain optimum return with

minimum risk is called portfolio construction. Individual securities have risk

return characteristics of their own. Portfolios may or may not take on the aggregate

characteristics of their individual parts. Diversification of investment helps

to spread risk over many assets. A diversification of securities gives the

assurance of obtaining the anticipated return on the portfolio. In a

diversified portfolio, some securities may not perform as expected, but others

may exceed the expectation and making the actual return of the portfolio

reasonably close to the anticipated one. Keeping a portfolio of single security

may lead to a greater likelihood of the actual return somewhat different from

that of the expected return. Hence, it is a common practice to diversify

securities in the portfolio. Commonly, there are two approaches in the

construction of the portfolio of securities viz. traditional approach and

Markowitz efficient frontier approach. In the traditional approach, investor’s

needs in terms of income and capital appreciation are evaluated and appropriate

securities are selected to meet the needs of the investor. The common practice

in the traditional approach is to evaluate the entire financial plan of the

individual. In the modern approach, portfolios are constructed to maximise the

expected return for a given level of risk. It views portfolio construction in

terms of the expected return and the risk associated with obtaining the

expected return.

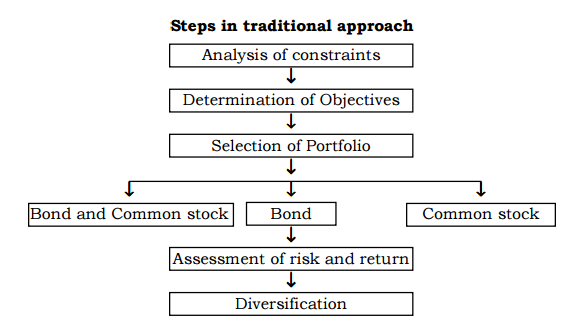

Traditional

approach - The

traditional approach basically deals with two major decisions. They are:

(a) Determining the objectives of the

portfolio.

(b) Selection of securities to be included in

the portfolio.

Normally, this is carried out in four

to six steps. Before formulating the objectives, the constraints of the

investor should be analysed. Within the given framework of constraints,

objectives are formulated. Then based on the objectives, securities are selected.

After that, the risk and return of the securities should be studied. The

investor has to assess the major risk categories that he or she is trying to

minimise. Compromise on risk and non-risk factors has to be carried out.

Finally relative portfolio weights are assigned to securities like bonds,

stocks and debentures and then diversification is carried out.The traditional

approach basically deals with two major decisions. They are: (a) Determining

the objectives of the portfolio. (b) Selection of securities to be included in

the portfolio. Normally, this is carried out in four to six steps. Before

formulating the objectives, the constraints of the investor should be analysed.

Within the given framework of constraints, objectives are formulated. Then based

on the objectives, securities are selected. After that, the risk and return of

the securities should be studied. The investor has to assess the major risk

categories that he or she is trying to minimise. Compromise on risk and

non-risk factors has to be carried out. Finally relative portfolio weights are

assigned to securities like bonds, stocks and debentures and 1. Analysis of

constraints- The constraints normally discussed are:then diversification is

carried out. income needs, liquidity, time horizon, safety, tax considerations

and the temperament.

Income needs- The income needs depend

on the need for income in constant rupees and current rupees. The need for

income in current rupees arises from the investor’s need to meet all or part of

the living expenses. At the same time inflation may erode the purchasing power,

the investor may like to offset the effect of the inflation and so, needs

income in constant rupees.

a)

Need for current income:

The investor should establish the income which the portfolio should generate.

The current income need depends upon the entire current financial plan of the

investor. The expenditure required to maintain a certain level of standard of

living and all the other income generating sources should be determined. Once this

information is arrived at, it is possible to decide how much income must be

provided for the portfolio of securities.

(b)

Need for constant income:

Inflation reduces the purchasing power of the money. Hence, the investor

estimates the impact of inflation on his estimated stream of income and tries

to build a portfolio which could offset the effect of inflation. Funds should

be invested in such securities where income from them might increase at a rate

that would offset the effect of inflation. The inflation or purchasing power

risk must be recognised but this does not pose a serious constraint on

portfolio if growth stocks are selected.

Liquidity- Liquidity need of the investment is

highly individualistic of the investor. If the investor prefers to have high

liquidity, then funds should be invested in high quality short term debt

maturity issues such as money market funds, commercial papers and shares that

are widely traded. Keeping the funds in shares that are poorly traded or stocks

in closely held business and real estate lack liquidity. The investor should

plan his cash drain and the need for net cash inflows during the investment

period.

Safety

of the principal-

Another serious constraint to be considered by the investor is the safety of

the principal value at the time of liquidation, investing in bonds and

debentures is safer than investing in the stocks. Even among the stocks, the

money should be invested in regularly traded companies of longstanding.

Investing money in the unregistered finance companies may not provide adequate

safety.

Time

horizon- Time

horizon is the investment-planning period of the individuals. This varies from

individual to individual. Individual’s risk and return preferences are often

described in terms of his ‘life cycle’. The states of the life cycle determine

the nature of investment. The first stage is the early career situation. At the

career starting point assets are lesser than their liabilities. More goods are

purchased on credit. His house might have been built with the help of housing

loan scheme. His major asset may be the house he owns. His priority towards

investments may be in the form of savings for liquidity purposes. He takes life

insurance for protecting him from unforeseen events like death and accidents

and then he thinks of the investments. The investor is young at this stage and

has long horizon of life expectancy with possibilities of growth in income, he

can invest in high-risk and growth oriented investments. The other stage of the

time horizon is the mid-career individual. At this stage, his assets are larger

than his liabilities. Potential pension benefits are available to him. By this

time he establishes his investment program. The time horizon before him is not

as long as the earlier stage and he wants to protect his capital investment. He

may wish to reduce the overall risk exposure of the portfolio but, he may

continue to invest in high risk and high return securities. The final stage is

the late career or the retirement stage. Here, the time horizon of the

investment is very much limited. He needs stable income and once he retires,

the size of income he needs from investment also increases. In this stage, most

of his loans are repaid by him and his assets far exceed the liabilities. His

pension and life insurance programmes are completed by him. He shifts his

investment to low return and low risk category investments, because safety of

the principal is given priority. Mostly he likes to have lower risk with high

interest or dividend paying component to be included in his portfolio. Thus,

the time horizon puts restrictions on the investment decisions.

Tax

consideration-

Investors in the income tax paying group consider the tax concessions they

could get from their investments. For all practical purpose, they would like to

reduce the taxes. For income tax purpose, interests and dividends are taxed

under the head “income from other sources”. The capital appreciation is taxed

under the head “capital gains” only when the investor sells the securities and

realises the gain. The tax is then at a concessioanl rate depending on the

period for which the asset has been held before being sold. From the tax point

of view, the form in which the income is received i.e. interest, dividend,

short term capital gains and long term capital gains are important. If the

investor cannot avoid taxes, he can delay the taxes. Investing in government

bonds and NSC can avoid taxation. This constraint makes the investor to include

the items which will reduce the tax.

Temperament- The temperament of the investor

himself poses a constraint on framing his investment objectives. Some investors

are risk lovers or takers who would like to take up higher risk even for low

return. While some investors are risk averse, who may not be willing to

undertake higher level of risk even for higher level of return. The risk

neutral investors match the return and the risk. For example, if a stock is

highly volatile in nature then the stock may be selling in a range of Rs.

100-200, and returns may fluctuate between Rs. 00- 100 in a year. Investors who

are risk averse would find it disturbing and do not have the temperament to

invest in this stock. Hence, the temperament of the investor plays an important

role in setting the objectives.

2.

Determination of objectives

Portfolios have the common objective of financing present and future

expenditures from a large pool of assets. The return that the investor requires

and the degree of risk he is willing to take depend upon the constraints. The

objectives of portfolio range from income to capital appreciation. The common

objectives are stated below:

Current income

Growth in income

Capital appreciation

Preservation of capital

The investor in general would like to

achieve all the four objectives, nobody would like to lose his investment. But,

it is not possible to achieve all the four objectives simultaneously. If the

investor aims at capital appreciation, he should include risky securities where

there is an equal likelihood of losing the capital. Thus, there is a conflict

among the objectives.

3.

Selection of portfolio

The selection of portfolio depends on the various objectives of the investor.

The selection of portfolio under different objectives are dealt subsequently.

Objectives and asset mix- If the main objective

is getting adequate amount of current income, sixty per cent of the investment

is made on debts and 40 per cent on equities. The proportions of investments on

debt and equity differ according to the individual’s preferences. Money is

invested in short term debt and fixed income securities. Here the growth of

income becomes the secondary objective and stability of principal amount may

become the third. Even within the debt portfolio, the funds invested in short

term bonds depends on the need for stability of principal amount in comparison

with the stability of income. If the appreciation of capital is given third

priority, instead of short term debt the investor opts for long term debt. The

period may not be a constraint. Growth of income and asset mix- Here the

investor requires a certain percentage of growth in the income received from

his investment. The investor’s portfolio may consist of 60 to 100 per cent

equities and 0 to 40 per cent debt instrument. The debt portion of the

portfolio may consist of concession regarding tax exemption. Appreciation of

principal amount is given third priority. For example computer software,

hardware and non-conventional energy producing company shares provide good

possibility of growth in dividend.

Capital

appreciation and asset mix-

Capital appreciation means that the value of the original investment increases

over the years. Investment in real estates like land and house may provide a

faster rate of capital appreciation but they lack liquidity. In the capital

market, the values of the shares are much higher than their original issue

prices. For example Satyam Computers, share value was Rs. 306 in April 1998 but

in October 1999 the value was Rs. 1658. Likewise, several examples can be

cited. The market capitalisation also has increased. Next to real assets, the

stock markets provide best opportunity for capital appreciation. If the

investor’s objective is capital appreciation, 90 to 100 per cent of his

portfolio may consist of equities and 0-10% of debts. The growth of income

becomes the secondary objective.

Safety

of principal and asset mix-

Usually, the risk averse investors are very particular about the stability of

principal. According to the life cycle theory, people in the third stage of

life also give more importance to the safety of the principal. All the

investors have this objective in their mind. No one like to lose his money

invested in different assets. But, the degree may differ. The investor’s

portfolio may consist more of debt instruments and within the debt portfolio

more would be on short term debts.

4.

Risk and return analysis:

The traditional approach to portfolio building has some basic assumptions.

First, the individual prefers larger to smaller returns from securities. To

achieve this goal, the investor has to take more risk. The ability to achieve

higher returns is dependent upon his ability to judge risk and his ability to

take specific risks. The risks are namely interest rate risk, purchasing power

risk, financial risk and market risk. The investor analyses the varying degrees

of risk and constructs his portfolio. At first, he establishes the minimum

income that he must have to avoid hardships under most adverse economic

condition and then he decides risk of loss of income that can be tolerated. The

investor makes a series of compromises on risk and non-risk factors like

taxation and marketability after he has assessed the major risk categories,

which he is trying to minimise. The methods of calculating risk and return of a

portfolio is classified in following pages of this chapter.

5.

Diversification:

Once the asset mix is determined and the risk and return are analysed, the

final step is the diversification of portfolio. Financial risk can be minimised

by commitments to top-quality bonds, but these securities offer poor resistance

to inflation. Stocks provide better inflation protection than bonds but are

more vulnerable to financial risks. Good quality convertibles may balance the

financial risk and purchasing power risk. According to the investor’s need for

income and risk tolerance level portfolio is diversified. In the bond

portfolio, the investor has to strike a balance between the short term and long

term bonds. Short term fixed income securities offer more risk to income and

long term fixed income securities offer more risk to principal. In the stock

portfolio, he has to adopt the following steps which are shown in the following

figure.

As investor, we have to select the

industries appropriate to our investment objectives. Each industry corresponds

to specific goals of the investors. The sales of some industries like two

wheelers and steel tend to move in tandem with the business cycle, the housing

industry sales move counter cyclically. If regular income is the criterion then

industries, which resist the trade cycle should be selected. Likewise, the

investor has to select one or two companies from each industry. The selection

of the company depends upon its growth, yield, expected earnings, past

earnings, expected price earning ratio, dividend and the amount spent on

research and development. Selecting the best company is widely followed by all

the investors but this depends upon the investors’ knowledge and perceptions

regarding the company. The final step in this process is to determine the

number of shares of each stock to be purchased. This involves determining the

number of different stocks that is required to give adequate diversification.

Depending upon the size of the portfolio, equal amount is allocated to each

stock. The investor has to purchase round lots to avoid transaction costs.

Modern approach: We have seen that

the traditional approach is a comprehensive financial plan for the individual.

It takes into account the individual needs such as housing, life insurance and

pension plans. But these types of financial planning approaches are not done in

the Markowitz approach. Markowitz gives more attention to the process of

selecting the portfolio. His planning can be applied more in the selection of

common stocks portfolio than the bond portfolio. The stocks are not selected on

the basis of need for income or appreciation. But the selection is based on the

risk and return analysis. Return includes the market return and dividend. The

investor needs return and it may be either in the form of market return or

dividend. They are assumed to be indifferent towards the form of return. Among

the list of stocks quoted at the Bombay Stock Exchange or at any other regional

stock exchange, the investor selects roughly some group of shares say of 10 or

15 stocks. For these stocks’ expected return and risk would be calculated. The

investor is assumed to have the objective of maximising the expected return and

minimising the risk. Further, it is assumed that investors would take up risk

in a situation when adequately rewarded for it. This implies that individuals

would prefer the portfolio of highest expected return for a given level of

risk. In the modern approach, the final step is asset allocation process that

is to choose the portfolio that meets the requirement of the investor. The risk

taker i.e. who are willing to accept a higher probability of risk for getting

the expected return would choose high risk portfolio. Investor with lower

tolerance for risk would choose low level risk portfolio. The risk neutral

investor would choose the medium level risk portfolio

Comments

Post a Comment