Compare and contrast preference share and equity share? Briefly explain the techniques for valuation of equity shares?

Compare and contrast preference

share and equity share? Briefly explain

the techniques for valuation of equity shares?

Equity

shares are the ordinary shares of the company. The holder of the equity shares

are the real owners of the company, i.e. the amount of shares held by them is the

portion of their ownership in the company.Equity shareholders have some

privileges like they get voting rights at the general meeting, they can appoint

or remove the directors and auditors of the company. Apart from that, they have

the right to get the profits of the company, i.e. the more the profit, the more

is their dividend and vice versa. Therefore, the amount of dividends is not

fixed. This does not mean that they will get the whole profit, but the residual

profit, which remains after paying all expenses and liabilities on the company.

Preference

Shares, as its name suggests, gets precedence over equity shares on the matters

like distribution of dividend at a fixed rate and repayment of capital in the

event of liquidation of the company.The preference shareholders are also the

part owners of the company like equity shareholders, but in general, they do

not have voting rights. However, they get right to vote on the matters which

directly affect their rights like the resolution of winding up of the company,

or in the case of the reduction of capital.

Comparison of Equity and Preference shares

BASIS

FOR COMPARISON

|

EQUITY

SHARES

|

PREFERENCE

SHARES

|

Meaning

|

Equity

shares are the ordinary shares of the company representing the part ownership

of the shareholder in the company.

|

Preference

shares are the shares that

carry

preferential rights on the matters of

payment

of dividend and repayment of capital.

|

Payment

of dividend

|

The

dividend is paid after the payment of all liabilities.

|

Priority

in payment of dividend over equity shareholders.

|

Repayment

of capital

|

In

the event of winding up of the company, equity shares are repaid at the end.

|

In

the event of winding up of the company, preference

shares are repaid before equity shares.

|

Rate

of dividend

|

Fluctuating

|

Fixed

|

Redemption

|

No

|

Yes

|

Voting

rights

|

Equity

shares carry voting rights.

|

Normally,

preference shares do not carry voting rights.

However, in special circumstances, they get

voting rights.

|

Convertibility

|

Equity

shares can never be converted.

|

Preference

shares can be converted into equity shares.

|

Arrears

of Dividend

|

Equity

shareholders have no rights to get arrears of the dividend for the previous

years.

|

Preference

shareholders generally get the arrears of

dividend

along with the present year's dividend, if not

paid

in the last previous year, except in the case of

non-cumulative preference shares.

|

Key Differences Between Equity Shares and Preference

Shares

1. Equity

shares cannot be converted into preference shares. However, Preference shares

could be converted into equity shares.

2. Equity

shares are irredeemable, but preference shares are redeemable.

3. The

next major difference is the ‘right to vote’. In general, equity shares carry

the right to vote, although preference shares do not carry voting rights.

4. If

in a financial year, dividend on equity shares is not declared and paid, then

the dividend for that year lapses. On the other hand, in the same situation,

the preference shares dividend gets accumulated which is paid in the next

financial year except in the case of non-cumulative preference shares.

5. The

rate of dividend is consistent for preference shares, while the rate of equity

dividend depends on the amount of profit earned by the company in the financial

year. Thus it goes on changing.

Valuation of Equity shares

Equity

shares can be described more easily than the fixed income securities. However

they are more difficult to analyze. Fixed income securities typically have a

limited life and a welldefined cash flow stream but equity shares have neither of

these. While the basic principles of valuation are same for fixed income

securities as well as equity shares, the factors for growth and risk create

greater complexity in case of equity shares. As our discussion in market

efficiency suggested that identifying mispriced securities is not easy. Yet

there are enough chinks in the efficient market hypothesis and hence the search

for mispriced securities cannot be dismissed out of hand. Moreover, it is the

ongoing search for mispriced securities by equity analysts that contributes to

a high degree of market efficiency. Equity analysts employ two kinds of

analysis – Fundamental analysis & Technical analysis. Fundamental analysts

assess the fair market value of equity shares by examining the assets, earnings

prospects, cash flow projections and dividend potential. Fundamental analysts

differ from technical analysts, who essentially rely on price and volume trends

and other market indicators to identify trading opportunities.T Equity shares

can be described more easily than the fixed income securities. However they are

more difficult to analyze. Fixed income securities typically have a limited

life and a welldefined cash flow stream but equity shares have neither of

these. While the basic principles of valuation are same for fixed income

securities as well as equity shares, the factors for growth and risk create

greater complexity in case of equity shares. As our discussion in market

efficiency suggested that identifying mispriced securities is not easy. Yet

there are enough chinks in the efficient market hypothesis and hence the search

for mispriced securities cannot be dismissed out of hand. Moreover, it is the

ongoing search for mispriced securities by equity analysts that contributes to

a high degree of market efficiency. Equity analysts employ two kinds of

analysis – Fundamental analysis & Technical analysis. Fundamental analysts

assess the fair market value of equity shares by examining the assets, earnings

prospects, cash flow projections and dividend potential. Fundamental analysts

differ from technical analysts, who essentially rely on price and volume trends

and other market indicators to identify trading opportunities.

A Philosophical Basis for Valuation

• There have always been investors in

financial markets who have argued that market prices are determined by the

perceptions (and misperceptions) of buyers and sellers, and not by anything as

prosaic as cash flows or earnings.

• Perceptions matter, but they cannot be all

the matter.

• Asset prices cannot be justified by merely

using the “bigger fool” theory.

Approaches

to Valuation 1. Balance Sheet Valuation 2. Dividend Discount Model 3. Earning

Multipliers Approach

Balance Sheet Valuation

Analysts often look at the balance sheet of the firm to get a handle on some

valuation measures. Three measures derive from the balance sheet are book

value, liquidation value and replacement cost.

Book Value -

The book value per share is simply the net worth of the company, which is equal

to the paid up equity capital plus reserves plus surplus, divided by the number

of outstanding equity shares. For example, if the net worth of Zenith Ltd is Rs

37 million and the number of outstanding shares of Zenith is 2 million, the

book value per share works out to be Rs 18.50 (Rs 37 million divided by 2

million). How relevant and useful is the book value per share as a measure of

investment value? The book value per share is firmly rooted in financial

accounting and hence can be established relatively easily. Due to this, its

proponents argue that it represents an ‘objective’ measure of value. A closer

examination, however, quickly revels that what is regarded as objective is

based on accounting conventions and policies, which are characterized, by a

great deal of subjectivity and arbitrariness. An allied and more powerful

criticism against the book value measures, is that historical balance sheet

figures on which it is based are often are very divergent from current economic

value. Balance sheet figure rarely reflect earning power and hence the book

value per share cannot be regarded as a good proxy for true investment value.

Liquidation Value

- The liquidation value per share is equal to: (Value realized from liquidating

all the assets of the firm — Amount to be paid to all the creditors and

preference shareholders) Number of outstanding equity shares To illustrate,

assume that Pioneer Industries would realize Rs 45 million from the liquidation

of its assets and pay Rs 18 million to its creditors and preference

shareholders in full settlement of their claims. If the number of outstanding

equity shares of Pioneer is 1.5 million, the liquidation value per share works

out to be: (Rs 45 million/ Rs 18

million) = Rs 18 1.5 Million

While

the liquidation value appears more realistic than the book value, there are two

serious problems in applying it. First, it is very difficult to estimate that

what amounts would be realized from liquidation of various assets. Second, the

liquidation value does not reflect earning capacity. Given these problems, the

measure of liquidation value seems to make sense only for firms, which are

‘better dead and alive’ – such firms are not viable and economic values cannot

be established for them.

Replacement Cost - Another

balance sheet measure considered by analysts in valuing a firm is the

replacement cost of its assets less liabilities. The use of this measure is

based on the premise that the market value of a firm cannot deviate too much

from its replacement cost. If it did so, competitive pressure will tend to

align the two. This idea seems to be popular among economists. The ratio of

market price to replacement cost is called Tobin q. the proponents of

replacement cost believe that in the long run Tobin’s q will tend to 1. The

empirical evidence, however, is that this ratio can depart significantly from 1

to long periods of time. The major limitation of the replacement cost concept

is that organizational capital, a very valuable asset, is not shown on the

balance sheet. Organizational capital is the value created by bringing together

employees, customers, suppliers, managers and others in a mutually beneficial

and productive relationship. An important characteristic of organizational

capital is that it cannot be easily separated from the firm as a going entity. Although

balance sheet analysis may provide useful information about book value,

liquidation value or replacement cost, the analyst must focus on expected

future dividends, earnings and cash flows to estimate the value of a firm as a

going entity.

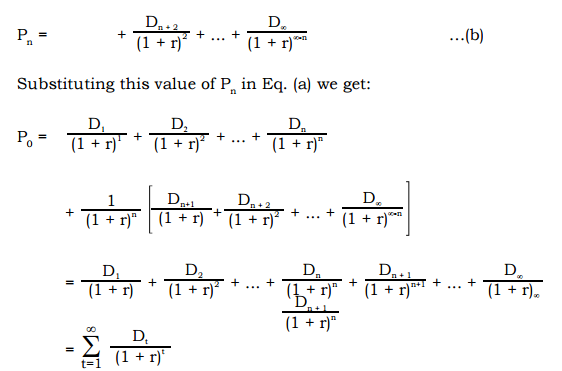

Capitalization of Income

Method of Valuation

There

are many ways to implement the fundamental analysis approach to identifying

mispriced securities. A number of them are either directly or indirectly

related to what is sometimes referred to as the capitalization of income method

of valuation. This method states that the true or intrinsic value of any asset

is based on the cash flow that the investor expects to receive in the future

from owning the asset. Because these cash flows are expected in the future,

they are adjusted by a discount rate to reflect not only the time value of

money but also the riskiness of the cash flows. Algebraically, the intrinsic

value of the asset V is equal to the sum of the present values of the expected

cash flows:

where

Ct denotes the expected cash flow associated with the asset at time t and k is

the appropriate discount rate for cash flows of this degree of risk. In this

equa-tion the discount rate is assumed to be the same for all periods. Because

the sym-bol ¥ above the summation sign in the equation denotes infinity, all

expected cash flows, from immediately after making the investment until

infinity, will be discounted at the same rate in determining V 2.

Net

Present Value - For the sake of convenience, let the current moment in time be

denoted as zero, or t = 0. If the cost of purchasing an asset at t = 0 is P,

then its net present value (NPV) is equal to the difference between its

intrinsic value and cost, or: NPV = V – P

The

NPV calculation shown here is conceptually the same as the NPV calcula-tion

made for capital budgeting decisions. Capital budgeting decisions involve

deciding whether or not a given investment project should be undertaken. (For

example, should a new machine be purchased?) In making this decision, the focal

point is the NPV of the project. Specifically, an investment project is viewed

favorably if its NPV is posi-tive, and unfavorably if its NPV is negative. For

a simple project involving cash outflow now (at t = 0) and expected cash

inflows in the future, a positive NPV means that the present value of all the

expected cash inflows is greater than the cost of making the investment.

Conversely, a negative NPV means that the present value of all the expected

cash inflows is less than the cost of making the investment. The same views

about NPV apply when financial assets (such as a share of common stock),

instead of real assets such as a new machine), are being consid-ered for

purchase. That is, a financial asset is viewed favorably and said to be

un-derpriced (or undervalued) if NPV > 0. Conversely, a financial asset is

viewed unfavorably and said to be overpriced or (overvalued) if NPV < 0.

From Equation (2), this is equivalent to stating that a financial asset is

underpriced if V > P:

Internal

Rate of Return- Another way of making capital budgeting decisions in a manner

that is similar to the NPV method involves calculating the internal rate of

return (IRR) associated with the investment project. With IRR, NPV in Equation

(2) is set equal to zero and the discount rate becomes the unknown that must be

calculated. That is, the IRR for a given investment is the discount rate that

makes the NPV of the investment equal to zero. Algebraically, the procedure

involves solving the fol-lowing equation for the internal rate of return k*:

Comments

Post a Comment