What are the recent developments in Indian stock market?

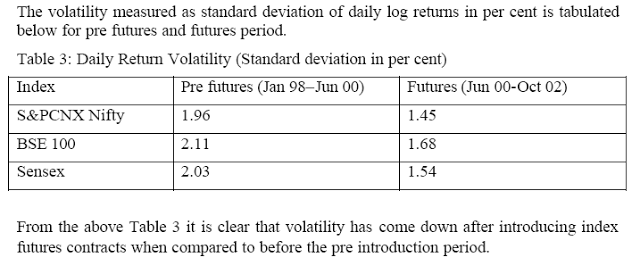

What are the recent developments in Indian stock market? The Indian regulatory and supervisory framework of securities market in India has been adequately strengthened through the legislative and administrative measures in the recent past. The regulatory framework for securities market is consistent with the best international benchmarks, such as, standards prescribed by International Organisation of Securities Commissions (IOSCO). Recent capital market reforms and an agenda for reforms are given below. 1. Extensive Capital Market Reforms were undertaken during the 1990s encompassing legislative regulatory and institutional reforms. Statutory market regulator, which was created in 1992, was suitably empowered to regulate the collective investment schemes and plantation schemes through an amendment in 1999. Further, the organization strengthening of SEBI and suitable empowerment through compliance and enforcement powers including search and seizure powers we...